I have been trading FOREX for more than 10 years and have tested dozens of Forex brokers to trade with. And in this post, I would like to talk about 2 of the brokers that I really liked and would recommend to anyone who just started trading Forex or want to carry their Forex trading career with a reliable and trustworthy Forex broker for ultimate success.

But before I tell you the brokers names, I would like to share with you what I look for in a broker to execute my trades with.

A few of the key features I look for in a Forex broker are the Regulation, new york close charts, spread, trade execution speed and bonus/tools or extra features.

And here's why these things matter -

Regulation: That's the first thing I see in a broker to understand and decide if my money is safe with them or not. There are many brokers I know that are doing business which are not regulated and hence deceived their clients in many ways such as by holding the clients deposited money and not letting the money to withdraw. Which is why it is very important that the broker is regulated in it's proprietary country.

Here is the link of almost all the regulatory organization bodies that regulates the broker companies. Check the list if your broker is regulated with any of these regulatory bodies or not.

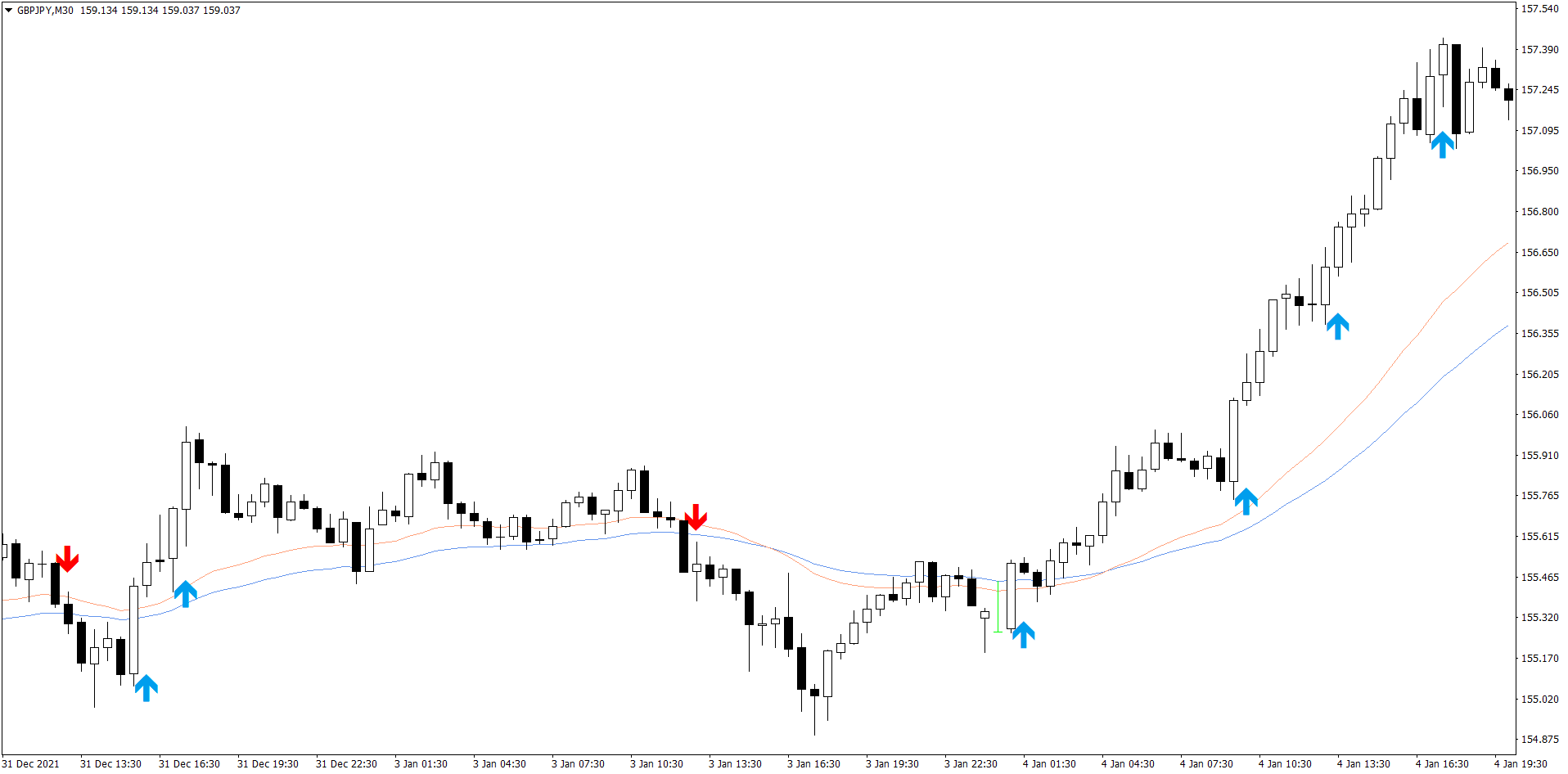

New York Close Charts: That's the 2nd thing I look for in a broker to be sure if they offer the right charting setups through the Meta trader or any of their trading softwares or not. By saying the right charting setup I mean the charts of New York close session bars. That's a very important thing to consider when you do technical analysis with the charts.

In New York closing charts, the daily candle closes on 4:59:59 pm New York time. New York close charts contains 5 candles in a week, while non-NY closing charts contains 6 daily candles where that extra candle misleads real price action data and hence false price action patterns. With NY closing charts you will get the most accurate data and chart price action patterns which will help you to analyze the market conditions very well other than those who uses non-NY charts.

Spread/Commission: It's very important that your broker does not charge huge amount of spread or commission per trading lot. I know a few of the well-reputed forex brokers who charge pretty high spread relative to the other brokers, which in sometimes 2-3 times more than average. You should switch a broker even if you can save 0.5 pips of spread.

Bonus/Tools or Extra Features: If a broker is regulated and reliable enough and at the same time giving bonus appreciations (deposit bonus or trade bonus) to their clients then that is a good point to consider on selecting that broker. I also look for if the broker also provides extra features to their clients for free, such as education materials(books, webinars, trading videos, courses), trading tools (indicators, plugins), personal trading manager, etc.

So, these are some of the key features I look for when choosing a Forex broker to deposit money and trade with that broker. There are also some other things I look for in a broker, but these are the main criteria a broker needs to have in order to meet my expectations.

Based on these features, I am currently trading with a few brokers, from which I like to recommend two of the brokers to my students and audiences. Both of these are reputed brokers which you can choose to do your trading with.

The first broker I recommend is Axitrader, and the 2nd broker I recommend is the FBS. They both have some common but important features along with their unique offers to their respective clients.

Below you will find brief information about these brokers to choose for your own trading.

NB: "Never deposit all of your hard earned money in one single broker. Spread your deposit and trade with multiple brokers to avoid any technical or unwanted issues with your account. The broker recommendations here is from my own observation and you should be careful and take full responsibility when trading with any broker you choose"